Direct Deposit Account

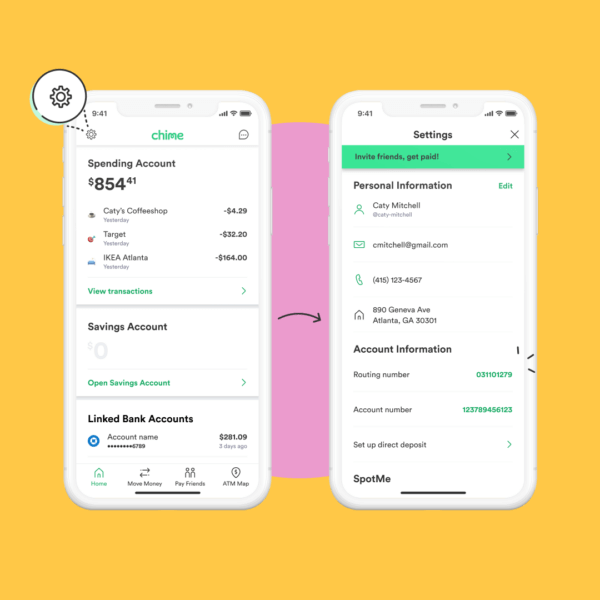

- Direct Deposit Account

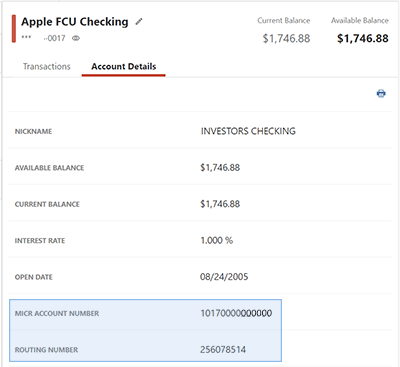

- Direct Deposit Account Number

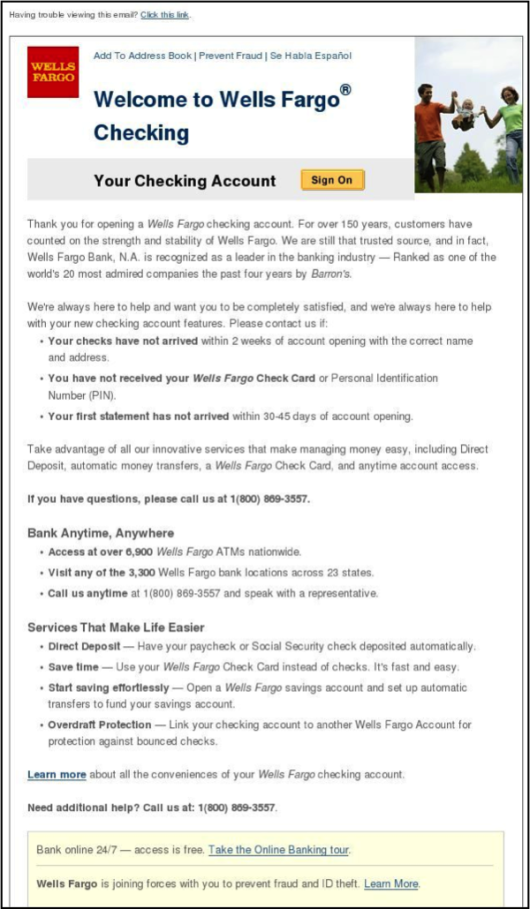

- Direct Deposit Account Set Up

- Direct Deposit Account Name

- Direct deposit account. If you choose to only have one (1) direct deposit account then section 3 should be left blank. If you choose to have two (2) direct deposit accounts you will need to fill out both section 2 and 3 and you must enter either a dollar amount or a percentage in section 3. If you already have a primary direct deposit.

- What Is Direct Deposit? Direct deposit is an electronic payment from one bank account to another. For example, money may move from an employer’s bank account to an employee’s bank account, although there are several other ways to use direct deposit.

Federal law mandates that all Federal benefit payments – including Social Security and Supplemental Security Income benefits – must be made electronically.

If you don’t have a bank account, prepaid debit cards, PayPal, and Venmo all offer direct deposit options for payroll checks, government benefits, and tax refunds. In some cases, early direct deposit is available, which means you will receive your direct deposit up to several days earlier than usual.

There are two ways you can receive your benefits:

- Into an existing bank account via Direct Deposit or

- Onto a Direct Express® Debit Mastercard®

Direct Deposit Account

Direct Deposit is the best electronic payment option for you because it is:

- Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen.

- Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month. And you'll have more time to do the things you enjoy!

- Convenient – With Direct Deposit, you no longer have to stand in line to cash your check when it arrives. Your money goes directly into your account. You don't have to leave your house in bad weather or worry if you're on vacation or away from home. You don't have to pay any fees to cash your checks. Your money is in your account ready to use when business opens the day you receive your check.

If you are applying for Social Security or Supplemental Security Income benefits, you must elect to receive your benefit payment electronically when you enroll. If you currently receive Social Security or Supplemental Security Income benefits by check, you must switch to an electronic payment option listed above.

To learn more about how to easily switch from a paper check to an electronic payment option, visit Treasury’s Go Direct website or call the Treasury’s Electronic Payment Solution Center at 1-800-333-1795. You can also create a mySocial Security account and start or change Direct Deposit online.

In extremely rare circumstances, Treasury may grant exceptions to the electronic payment mandate. For more information or to request a waiver, call Treasury at 855-290-1545. You may also print and fill out a waiver form and return it to the address on the form.

If you have any questions, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

A direct deposit (or direct credit), in banking, is a deposit of money by a payer directly into a payee's bank account. Direct deposits are most commonly made by businesses in the payment of salaries and wages and for the payment of suppliers' accounts, but the facility can be used for payments for any purpose, such as payment of bills, taxes, and other government charges. Direct deposits are most commonly made by means of electronic funds transfers effected using online, mobile, and telephone banking systems but can also be affected by the physical deposit of money into the payee's bank account.

When making a direct deposit by means of electronic funds transfer, the payer also normally enters reference information to make it easy for the payee to recognise who made the deposit and which account to credit. The reference may be an account number, an invoice number, the payer's name, or some other meaningful identification. To ensure that the payee is aware of the deposit, the payer commonly follows up by sending to the payee a remittance advice.

The direct deposit facility is often better known by country-specific payment systems used to action these payments such as the following:

- Giro in most of Europe

- ACH Network (ACH) in the United States

- Direct entry in Australia

Alternatives[edit]

If a funds recipient does not have a bank account, but a payer is obligated to pay by electronic funds transfer, alternative payment arrangements need to be made. For example, a US law of 1996 required the federal government to make electronic payments, such as direct deposit, available by 1999. As a part of its implementation, the US Treasury Department paired with Comerica Bank and MasterCard in 2008 to offer the Direct Express Debit MasterCardprepaid debit card, which can be used to make payments to federal benefit recipients who do not have a bank account.[1]

See also[edit]

Direct Deposit Account Number

References[edit]

Direct Deposit Account Set Up

- ^'Federal government chooses direct deposit and prepaid cards over mailing checks'Archived 2013-04-23 at the Wayback Machine, BankCreditNews, 15 April 2013, accessed 22 April 2013.