Deposit Cheque Online

Are you familiar with mobile check deposits?

Yes, the same applies for depositing someone else’s check through an ATM. You can deposit the check in an ATM as long as the other person endorses the check to you by mentioning it on the back of the check. In the computer age, it is entirely possible to deposit the check through an online photo deposit.

- The cheque is in date; The cheque has been signed and dated; The cheque has both the words and figures on the front of the cheque and that these match; That both the sort code and account number is included on the back of the cheque on the right hand side (we will pay the cheque to the account confirmed on the back of the cheque).

- Making a mobile check deposit is easy, secure, and convenient. Complete the process in five easy steps. Log into your account through the Fifth Third Mobile Banking app, and select Check Deposit. Verify the account you want the check to be deposited into. Enter the check amount. Take photos of the front and back of your check with your phone.

- The ‘Deposit History’ tab is a good place to view cheques paid in previously. If a cheque is rejected please do not try to pay it in with the app again – the reason for rejection will be shown in ‘Deposit History’.

This means you can deposit checks without going to the bank. And, being able to deposit paper checks, such as a stimulus check, without going to the bank can make things super convenient.

Wondering how to deposit a check this way? If you’ve never used mobile check deposit before, it’s not as difficult as you might think. Take a look at 5 tips that can help you make the most of this feature – saving you valuable time.

1. Check your bank’s mobile check deposit guidelines

The first thing you need to do is make sure the organization you’re banking with is set up for mobile check deposits. The easiest way to do that is to check your mobile banking app.

When you log into mobile banking, head to the menu and look for the mobile check deposit option. If you see it listed, then your app should allow you to deposit checks online.

Before you try to use mobile check deposit, however, make sure your account is enabled to do so. While the feature may be available in mobile banking, you may still have to register first or sign up.

2. Review mobile check deposit limits

If you know that you’re able to deposit a check through mobile banking, the next step is to determine whether there are any limits on deposits.

For example, some financial institutions impose limits on the number of checks you can deposit per day or per week. There may also be daily, weekly or monthly limits on the total dollar amount you can add to your bank account using mobile check deposit.

So, make sure you can deposit your check without going over those limits. For example, say you’re married with two kids and you received a federal stimulus check for $3,400. If your bank’s mobile check deposit limit is $5,000 per day, you should be able to deposit the entire check online.

You can usually find out about limits if you read your bank account’s terms and conditions. You can also check your online banking website and look for a section on frequently asked questions. Sometimes this is a good place to start.

What if your check is outside mobile check deposit limits? In this case, you’ll need to find a work-around for depositing it into your bank account. With online bank accounts, for instance, you may have to deposit the money to a checking account at a brick-and-mortar bank, and then move it into your other account via an ACH transfer.

3. Get your check ready for deposit

Depositing a check online isn’t exactly the same as depositing it at a branch or ATM. But you still have to sign the back of the check for the deposit to be valid. You also should make sure all the information on the front of the check is correct.

Depending on your bank account, you may also have to write something extra on the back to denote that it’s a mobile deposit. For example, you may have to add “for mobile deposit” or “for remote deposit capture” below your signature.

Also, make sure the check is legible. Your mobile device needs to be able to “read” the check via the camera when you’re ready to deposit it.

4. Deposit your check via mobile banking

Now you’re ready to deposit a check online!

The process can be different depending on your particular bank account. But generally, here’s what you need to do:

- Log into your mobile banking app

- Find the mobile check deposit option in the menu

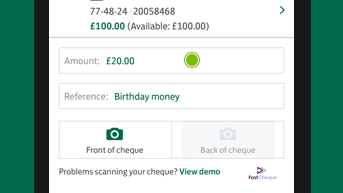

- Select the account you want to deposit the check into (i.e. checking or savings)

- Enter the check amount

- Snap a photo of the check – front and back. It’s important to make sure you get a clear image of both sides of the check. Otherwise, you may have trouble completing a mobile check deposit. If the images come out fuzzy or blurry, clean off your camera lens. And, make sure you take photos in an area with good lighting so your camera can pick up details on your check.

- Once your device records the images of your check, review the deposit details. Make sure that you’ve signed the check, selected the right account, and entered the correct amount.

5. Wait for the check to clear

If you deposit a stimulus check – or any check – online, you may want to use the money right away. But, you’ll need to wait for the check to clear in your bank account first.

You may now wonder how long it takes for mobile check deposits to clear. Well, this depends on your bank account, the amount of check, and the type of check involved. Again, check your bank account terms and conditions or read through the FAQs. This might offer up some clarity on how long your mobile check deposit will take to be fully credited to your account.

In the meantime, don’t throw the check away. Why? Because there may be a hiccup with your mobile check deposit. If you don’t see the deposit in your account within a week, you may need to call your financial institution to find out what’s happening. You may also need to try making the deposit again.

Deposit Cheque Online Pnc

Once your mobile check deposit clears your bank account, you can then write ‘void’ on the check and file it away.

How to deposit IRS checks with Mobile Check Deposit using Chime

If you are a Chime member and received a government stimulus payment as a paper check, you can deposit it safely and securely at Chime. We take our members’ money seriously, so for these checks, we’re putting extra security measures in place. Here’s how to deposit your IRS checks using our Mobile Check Deposit feature.

1.Make sure the name on the check matches your Chime Spending Account

2. For joint stimulus checks, make sure at least one filer’s name matches the name associated with the Chime Account. Unfortunately, we can’t accept checks that don’t have your name on it

3. Sign the back of your paper check, then write “For deposit to Chime only” under your signature.

For joint stimulus check make sure both of your signatures appear on the back of the check.

4. Open the Chime app, tap Move Money at the bottom of your screen, then tap Mobile Check Deposit, then U.S. Treasury.

Keep in mind: Mobile Check Deposit for stimulus checks is only available to members that actively use their Chime Spending Account and Chime Visa® Debit Card

5. The Chime app will guide you through the check deposit process – it’s easy!

Are you using a mobile banking app for check deposit yet?

Signing up for direct deposit can save you time, but mobile check deposit comes in super handy if you receive a paper check, like a tax refund or stimulus check.

Rbc Deposit Cheque Online

So, if you aren’t taking advantage of mobile check deposit yet, consider signing up. You’ll soon learn just how convenient it is!

With the convenience of mobile banking services, it’s pretty easy to deposit check by just taking a couple of photos with your phone. But it’s important to remember that you still have to be careful about what happens to that paper check; just ask the Arizona woman who is out $1,500 after using the Bank of America mobile app to deposit a check

It’s good practice to write “deposited” on any check you deposit with a mobile app, and then, once it’s been accepted by your bank, destroy it.

That’s a lesson one Bank of America customer customer learned the hard way — and lost a lot of money in the process: ABC 12 News in Arizona has the story of a woman who used the bank’s mobile app to deposit a check for $1,500.

“I read terms and agreements. I make sure I’m doing things the right way,” the Scottsdale resident told the news station.

But two months after she deposited the check, she says the bank debited $1,500 from her checking account with no explanation. She called the bank to find out what the heck was going on.

“And they said ‘We can’t tell you’,” she says. She did her own digging, and even filed a police report to uncover more information.

As it turns out, after she’d deposited the check, it was apparently stolen. Even though her mobile deposit of the check had gone through, someone — caught on grainy ATM video — was able to cash that check a second time. The scammer even added a second signature to the back.

This second cashing of the check resulted in Bank of America debiting the customer’s account for the amount of the earlier deposit.

BofA has been made aware of the situation, but seems to indicate that this is all on the customer’s shoulders.

“To help prevent checks from being negotiated more than once, customers using mobile check deposit are directed in our Mobile Check Deposit Agreement to write ‘Deposited’ on the check and destroy the original check promptly after the deposit has been acknowledged,” a spokesperson said. “As long as the ‘live’ check is still in existence, there is a chance that it could be negotiated more times.”

The bank added that it is “not at liberty to discuss the transaction information captured in ATM footage.”

The customer calls BofA’s response “disappointing,” and says she will be pulling all her accounts with the bank.

“I’ll never deposit anything mobily ever again,” said Rogers.

As with any banking document you receive, make sure you comb the fine print so you know how long you need to keep the original check, and your rights regarding disputes. And again, write a big fat DEPOSITED on it while you’re waiting for it to be accepted, and destroy it when all is said and done. Paper shredders are known to do the trick.

Can We Deposit Cheque Online

Editor's Note: This article originally appeared on Consumerist.