Co Operative Bank Fixed Deposit Interest Rates

- Co Operative Bank Fixed Deposit Interest Rates Tamilnadu

- Co Operative Bank Fixed Deposit Interest Rates Calculator

- Co Operative Bank Fixed Deposit Interest Rates Wells Fargo Home Mortgage

Fixed Deposit

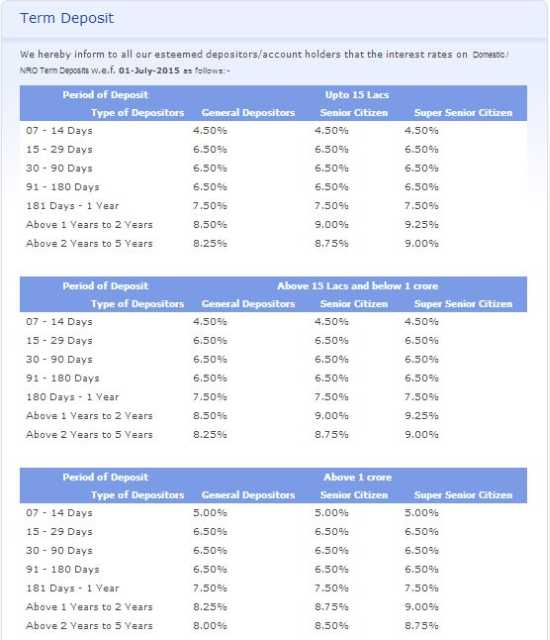

Fixed Deposit is also known as Term Deposit. Fixed Deposit means an amount is deposited at Bank for a fixed period. The bank offers a fixed rate of interest for that period. The banks offers a wide range of period; from 15 days to 5 years. The interest rate varies according to the duration

Savings Bank A/c

- The RBI has put restrictions on withdrawals from Independence Co-operative Bank Limited, Nashik because of the lender's present liquidity position. However, 99.89% of the depositors are fully.

- Fixed Term Deposits Safe and Secure way to earn income. New India Co-Operative Bank Limited offers you, your family & friends a variety of Fixed deposits. You can deposit any amount of money starting at a minimum of Rs. 1000/- in your Fixed deposit.

Certificates of Deposit - Branch Banks 2021. A certificate of deposit (CD) is a savings product offered by a bank in which a depositor (someone who has money to put into the bank) agrees to commit a certain amount of money for a set period of time, in return for a fixed rate of interest. Checking the Bharat Co-operative Bank fixed deposit interest rate and making the decisions is now very easy. For domestic deposits - 15 lakh and above Less than Rs. Maturity Period.

Co Operative Bank Fixed Deposit Interest Rates Tamilnadu

Saving Bank Account has been introduced in banks with a primary intention of developing the saving habits of ordinary people. It allows one to deposit his cash in the bank even in small amounts and withdraw his money whenever he wants. Safety is one of the attractive benefit. An SB Account offers a moderate interest rate also. The rate of interest is decided by Reserve Bank of India and it is periodically reviewed.

Current Account

Current Account is mainly for businessmen, firms, companies, public enterprises etc. which do numerous daily banking transactions. In a CD A/c the account holder can deposit or withdraw money as many times, limiting to the availability of amount in his account. It is zero-interest based deposit, which means the amount in the CD a/c will not get any interest. It is meant only for the convenience of money transactions.

Co Operative Bank Fixed Deposit Interest Rates Calculator

NRE Deposit Scheme

Co Operative Bank Fixed Deposit Interest Rates Wells Fargo Home Mortgage

Reserve Bank of India has issued authorization to maintain NRE Account (Non-Resident (E) Account vide KOC.FEO.FMID.2804/88.02.030/2016-17 dated April 18, 2017 to our Bank. NRE Account can be opened by any person who is residing outside India. As per Income Tax rules, an individual is considered as a ‘resident’ if he is in India during any financial year for a period not less than 182 days. NRI is an individual migrated for six months or more who hold an Indian Passport. All the funds along with the accrued interest are freely repatriable in NRE Accounts. Savings Bank Account, Current Deposit and Term Deposits can be opened as NRE Account. Interest on NRE Account are not taxable and at the same time, the interest on NRO Account is taxable. Rupee fund generated in India is not permitted for deposit in NRE Account. Joint holding with Resident Indians are also not permitted in NRE Accounts.